Overview of the PET Research project:

Imagine that an organisation stores a vast amount of data in a safe. The information is secure, but to produce any summary reports of the data or to query that data, the data must be removed from the safe for analysis. At this point of analysis, all of the raw sensitive data is exposed. Now imagine that pre-defined queries and macro analysis could take place on the data without the safe ever being opened. Further still, data in multiple safe environments, across multiple organisations (in multiple countries), could be analysed collectively, by consent of the data owners, without any raw sensitive data leaving their safe environments. Queries that yield no sensitive information can be executed on sensitive data, held within the safe environments, without any sensitive information being disclosed at any point.

This is the promise of privacy preserving analysis, using privacy enhancing technologies (PETs).

This is the promise of privacy preserving analysis, using privacy enhancing technologies (PETs).

RelevanT Publications

|

Version 1.3. (January 2021)

FFIS Innovation and discussion paper: "Case studies of the use of privacy preserving analysis to tackle financial crime"

| |||||||

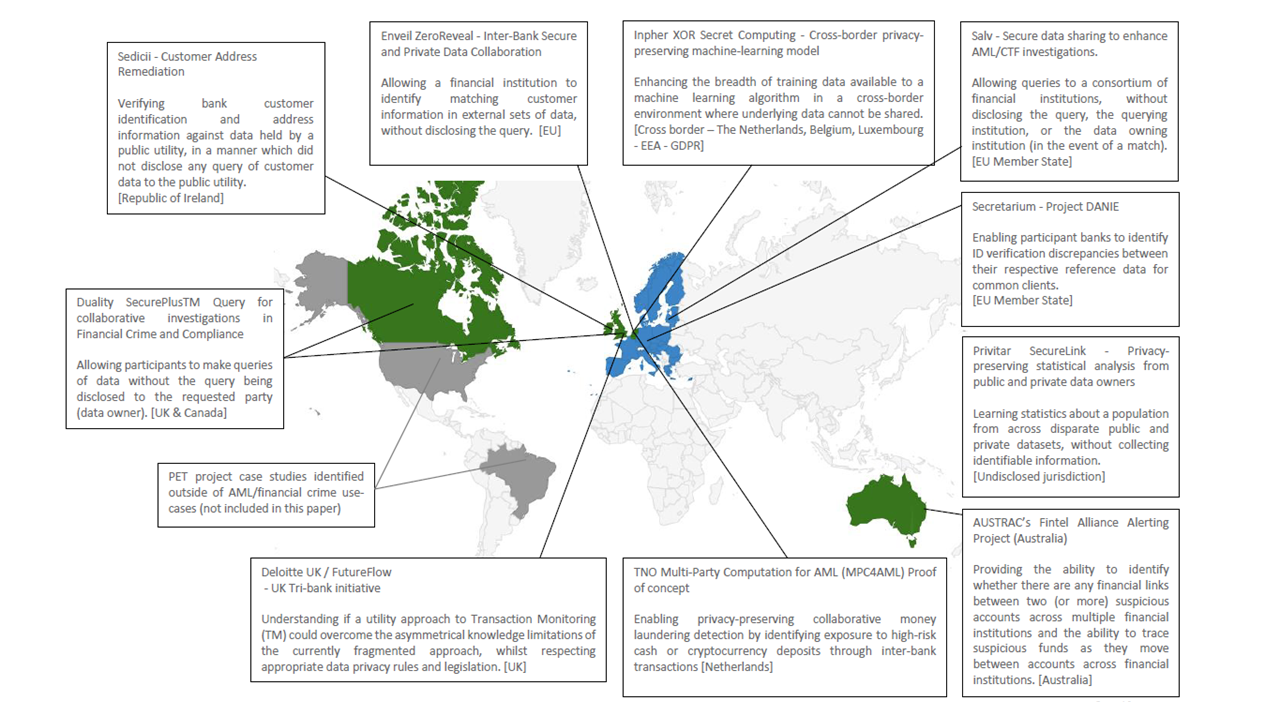

The paper provides an overview of developments in the field of privacy preserving analytics and publishes ten case studies of how this technology is being used to tackle financial crime, updated to January 2021.

Collectively, the case studies demonstrate how financial institutions are exploring and exploiting advances in this field of cryptographic technology to enable analysis of data from across multiple participating organisations to inform financial crime risk awareness, without the need for those organisations to share underlying sensitive data.

Collectively, the case studies demonstrate how financial institutions are exploring and exploiting advances in this field of cryptographic technology to enable analysis of data from across multiple participating organisations to inform financial crime risk awareness, without the need for those organisations to share underlying sensitive data.

The Research Technical Advisory Group (RTAG)

To support this research project, the FFIS programme is grateful for contributions from our 'Research Technical Advisory Group', which includes:

Duality Technologies

https://dualitytech.com/

Enveil

https://www.enveil.com/

eXate Technology

https://www.exate.com/

IBM Technology

https://www.ibm.com/security/privacy

Inpher

https://www.inpher.io/

Privitar

https://www.privitar.com/

Salv

https://salv.com/

Sedicii

https://sedicii.com/

We are also grateful for the technical input and workshop contributions from the following public agencies:

The Australian Transaction Reports and Analysis Centre (AUSTRAC)

The UK Financial Conduct Authority

The UK Information Commissioner's Office

The Netherlands Financial Intelligence Unit

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

Duality Technologies

https://dualitytech.com/

Enveil

https://www.enveil.com/

eXate Technology

https://www.exate.com/

IBM Technology

https://www.ibm.com/security/privacy

Inpher

https://www.inpher.io/

Privitar

https://www.privitar.com/

Salv

https://salv.com/

Sedicii

https://sedicii.com/

We are also grateful for the technical input and workshop contributions from the following public agencies:

The Australian Transaction Reports and Analysis Centre (AUSTRAC)

The UK Financial Conduct Authority

The UK Information Commissioner's Office

The Netherlands Financial Intelligence Unit

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)