'Five Years of Growth of Public-Private Partnerships to Fight Financial Crime'

FFIS Survey Report

Nick J Maxwell, August 2020

A FFIS survey reveals international growth of public–private financial information-sharing partnerships to tackle financial crime, from 2015 to 2020, and describes recent activity directed against COVID-19 crime threats.

This paper is the result of an international survey of public–private financial information sharing partnerships to disrupt crime, which took place between April and June 2020.

The report provides descriptive summaries of 23 national and trans-national financial information-sharing partnerships and provides new insights into the impact of such partnerships in tackling financial crime; including their role in responding to COVID-19.

This paper is the result of an international survey of public–private financial information sharing partnerships to disrupt crime, which took place between April and June 2020.

The report provides descriptive summaries of 23 national and trans-national financial information-sharing partnerships and provides new insights into the impact of such partnerships in tackling financial crime; including their role in responding to COVID-19.

DOWNLOAD THE FULL REPORT

| five_years_of_growth_of_public-private_partnerships_to_fight_financial_crime_-_18_aug_2020.pdf |

'Expanding the Capability of Financial Information-Sharing Partnerships'

RUSI Occasional Paper

Nick J Maxwell, March 2019

Download the full report:

DOWNload the RESEARCH Précis:

|

This report:

• Describes the development of new partnerships since the previous FFIS study and sets out the latest data relating to the performance of those partnerships. • Presents a range of development themes for partnership decision-makers to consider, highlighting both challenges and opportunities to expand the capability and impact of partnerships.

| ||||

'The Role of Financial Information-Sharing Partnerships (FISPs) in the Disruption OF Crime'

RUSI Occasional Paper

Nick J Maxwell and David Artingstall, Oct 2017

The volume of suspicious transaction reports submitted by banks and others across key financial centres is growing at 11% per year, with over 2.6 million reports expected to be filed in the UK and the United States in 2017. However, the study finds that between 80% to 90% of this suspicious reporting is not useful to active law enforcement investigations.

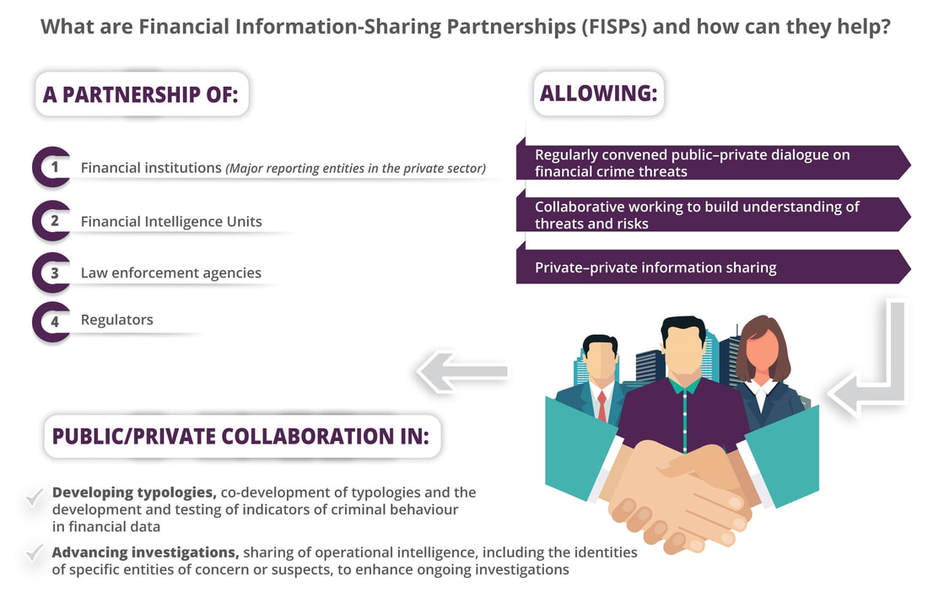

Responding to these challenges, this report examines the emergence of new information-sharing partnerships between financial institutions and law enforcement agencies, set up in a small number of countries, which allow public and private institutions to share insights on terrorist and serious crime threats.

Download the full report:

DOWNload the INFOGRAPHIC RESEARCH SUMMARY

Spanish Language infographic

|

This report:

• Provides the first international study of FISPs, describing current international variation across the US, the UK, Canada, Australia, Hong Kong and Singapore. • Draws lessons and establishes good practice from existing models to support and inform national and international policymakers to develop FISPs and increase the efficacy of the fight against money laundering. • Establishes a principles-based approach to the development of FISPs. • Raises further reflections for international policymakers about the strategic approach to tackling financial crime. | ||||||