'The Role of Financial Information-Sharing Partnerships (FISPs) in the Disruption OF Crime'

RUSI Occasional Paper

Nick J Maxwell and David Artingstall, Oct 2017

The volume of suspicious transaction reports submitted by banks and others across key financial centres is growing at 11% per year, with over 2.6 million reports expected to be filed in the UK and the United States in 2017. However, the study finds that between 80% to 90% of this suspicious reporting is not useful to active law enforcement investigations.

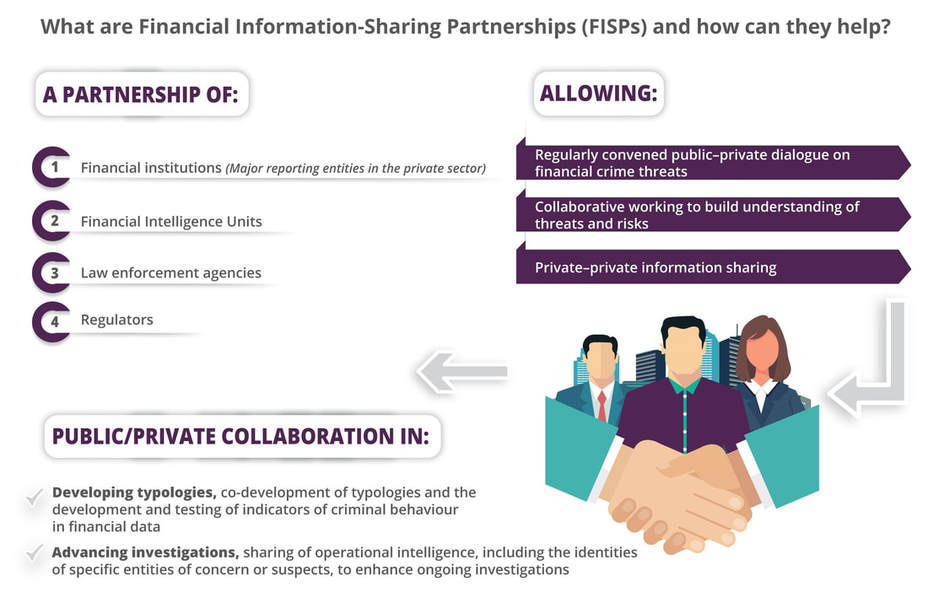

Responding to these challenges, this report examines the emergence of new information-sharing partnerships between financial institutions and law enforcement agencies, set up in a small number of countries, which allow public and private institutions to share insights on terrorist and serious crime threats.

Download the full report:

DOWNload the INFOGRAPHIC RESEARCH SUMMARY

Spanish Language infographic

|

This report:

• Provides the first international study of FISPs, describing current international variation across the US, the UK, Canada, Australia, Hong Kong and Singapore. • Draws lessons and establishes good practice from existing models to support and inform national and international policymakers to develop FISPs and increase the efficacy of the fight against money laundering. • Establishes a principles-based approach to the development of FISPs. • Raises further reflections for international policymakers about the strategic approach to tackling financial crime. | ||||||